Insights from Innoship’s E-Commerce Index Q1 2024: Trends and Growth in the Romanian Market

The first quarter of 2024 has brought interesting dynamics to Romania’s e-commerce landscape, as detailed by the data analysis collected across our platform. At the end of each quarter, Innoship shares key insights into market performance, consumer behaviour changes, and the evolving dynamics of the e-commerce industry.

E-commerce Market Grows +4.7% in Q1 2024: A Detailed Analysis of Trends and Evolution.

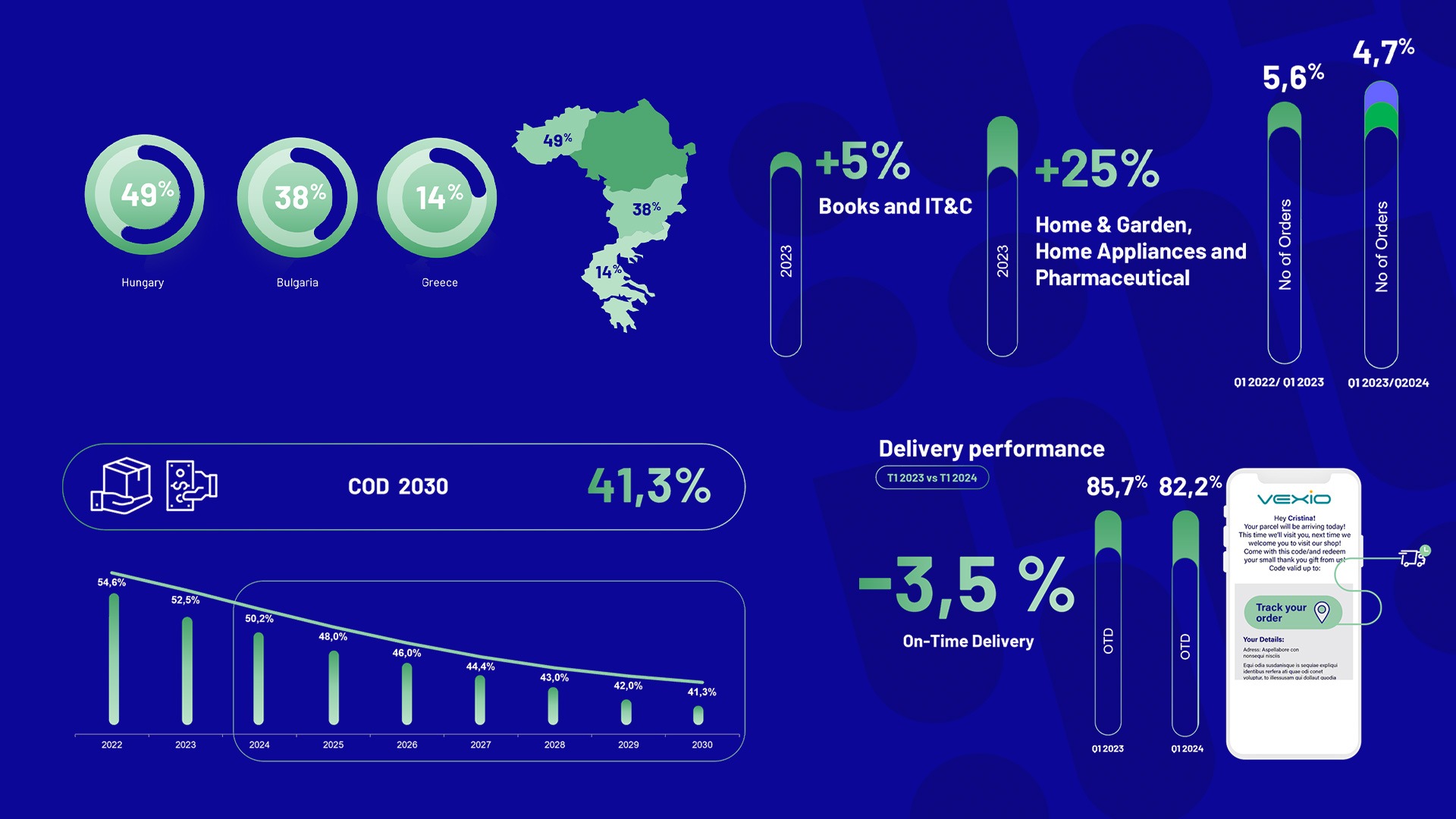

In the first quarter of 2024, the e-commerce sector experienced a 4.7% increase in order volumes compared to the first quarter of 2023, per the Innoship platform’s data analysis. This represents a moderate growth, lower than the previous year’s increase of 5.6% over 2022. The post-Black Friday period of 2023 was an expected trend, with January 2024’s e-commerce volumes unexpectedly aligning with the high levels of the preceding December instead of declining to the usual post-holiday levels. This persistence of high order volumes into the new year highlights a shift in consumer behavior and illustrates the local e-commerce market’s adaptability and resilience amidst evolving conditions.

Adjusting Consumer Preferences and Their Effects on Industry Order Volumes

There’s a noticeable shift in consumer spending towards essential products, signalling how the market is adapting to evolving economic and social landscapes. This shift has led to stagnant or minimal growth in sectors such as Books and IT&C, highlighting a reevaluation of consumer priorities. On the other hand, the Home & Garden, Home Appliances

+

An increasing number of consumers prefer alternative delivery options, such as lockers or pick-up/drop-off points (PUDOs), over traditional home delivery. This trend rose from 12% to 15% of total orders in the first quarter of 2024 compared to the same period in 2023.

This shift is driven from one side by the decreased shipping cost of these options for e-commerce businesses and the convenience for consumers, who appreciate the flexibility of not being bound by a delivery schedule. Despite this growing trend, the efficiency of door-to-door deliveries for quick shipments (24-hour delivery) remains a top preference, indicating that the preference for lockers and PUDOs doesn’t detract from the effectiveness of traditional delivery services.

2.3% Decline of Cash on Delivery in Online Purchases in the First Quarter of 2024

There’s a gradual decline in the use of cash on delivery (COD) for online purchases, with a 2.3% decrease observed in the first quarter of 2024 from the year before. This downward trend, which saw COD payments drop from 52.5% to 50.2% of total deliveries, is expected to continue at a slower pace, aiming for a level around 41% by 2030. This shift is most pronounced, with almost a 10% drop, among companies that have built consumer trust through strategic positioning and customer-focused practices, highlighting the importance of confidence in online transactions.

Cross-border Delivery Growth into Neighboring Markets Hungary +49%; Bulgaria +38%; Greece +14%

The expansion of cross-border deliveries showcases significant growth in shipments to Hungary, Bulgaria, and Greece, with increases of 49%, 38%, and 14%. This growth is largely fueled by the rise of marketplace sales, prompting companies to broaden their market presence across these countries over the past year. These trends emphasize the increasing economy of regional markets and the opportunities for cross-border e-commerce expansion for local eCommerce companies.

Delivery Performance Trends: A Drop of 3.5% in On-time Deliveries

The courier sector witnessed a 3.5% drop in on-time delivery (OTD) performance in the first quarter of 2024 compared to the same period in 2023. This decline in performance metrics highlights the challenges facing the courier industry in maintaining service levels, underscoring the need for continuous improvements in delivery efficiency and reliability.

On-time delivery (OTD) performance dropped from 85,7% in T1 2023 to 82,2% in T1 2024 of total deliveries.

Conclusions

Innoship’s detailed analysis for Q1 2024 presents a mixed but optimistic picture of Romania’s e-commerce sector. While there are challenges, such as fluctuating consumer preferences and delivery performance issues, the overall growth trajectory and the expansion into new delivery methods and markets also suggest interesting opportunities.

For e-commerce businesses, staying informed and adaptable will be key to capitalising on these emerging opportunities.